Tax back calculator

Owe IRS 10K-110K Back Taxes Check Eligibility. The amount of tax you will get back in this years refund depends on factors such as your income number of dependents and type of deduction.

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Our Tool Tax Back Calculator gives you an idea of how much your claim could be worth.

. Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator. How It Works. Before you use the.

Before applying for your Irish tax refund its good to. Ad The IRS contacting you can be stressful. Estimate your federal income tax withholding.

Answer the simple questions the calculator asks. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Which tax year would you like to calculate.

Did you work for an employer or receive an annuity from a fund. It takes just 2 minutes to use and could lead to you getting a significant amount of UK tax back. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Effective tax rate 172. See if you Qualify for IRS Fresh Start Request Online. Get help Apply Now Download the.

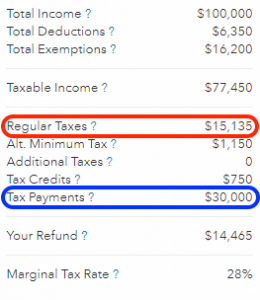

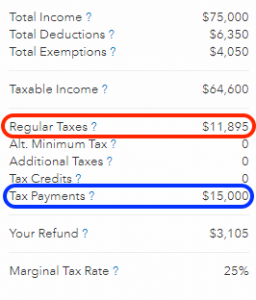

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Step 3 Add the total amount of tax. Ad Owe back tax 10K-200K.

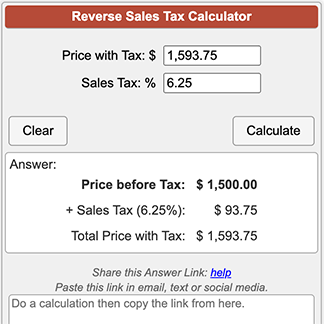

Start with a free consultation. We work with you and the IRS to settle issues. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

Need help with Back Taxes. This calculator is for 2022 Tax Returns due in 2023. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Use this tool to. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. But how much can YOU claim.

Calculating your UK Tax Refund is super simple. Use the free UK tax refund calculator today. Aprio performs hundreds of RD Tax Credit studies each year.

Step 2 Add in your gross total pay for that tax year. As with all our free calculators this is an approximate figure that you will firm up when preparing your. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

If you have more than one IRP5IT3a please enter totals for all of them added. You can estimate the amount of. You have to give a.

You dont have to be 100 exact. Step 1 Select the tax year you want to claim for. This calculator will help you work out your tax refund or debt estimate.

It can be used for the 201516 to 202122 income years. Your household income location filing status and number of personal. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

See how your refund take-home pay or tax due are affected by withholding amount. Irish Tax Refund Calculator.

Self Employed Tax Calculator Business Tax Self Employment Self

How To Calculate Income Tax In Excel

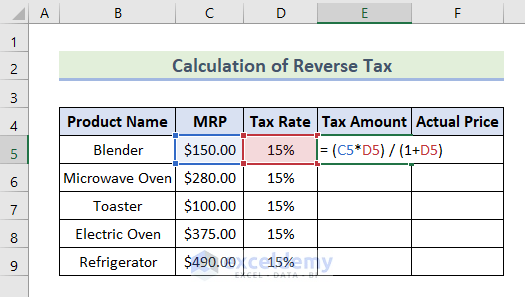

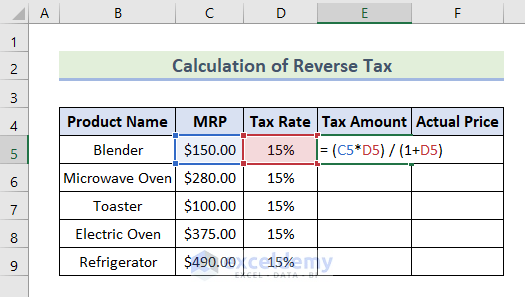

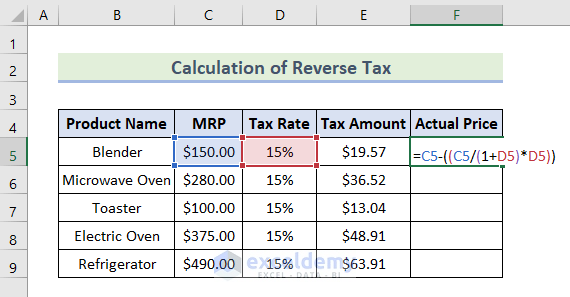

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Effective Tax Rate Formula Calculator Excel Template

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Property Tax Calculator

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Tax Return Calculator How Much Will You Get Back In Taxes Tips

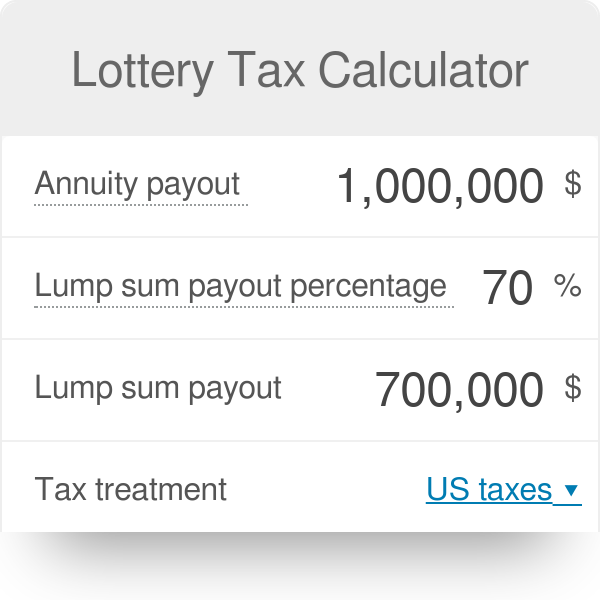

Lottery Tax Calculator

Reverse Sales Tax Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

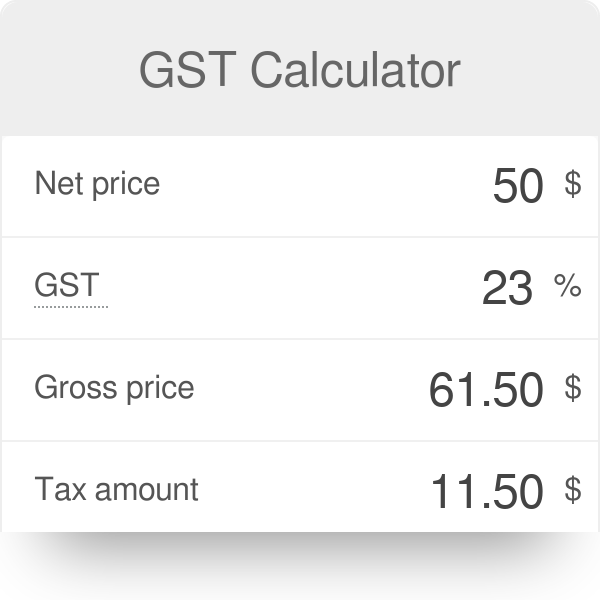

Gst Calculator

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Sales Tax Calculator

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Excel Formula Income Tax Bracket Calculation Exceljet